BY MAYRA PARIS

Money

If you’re a renter, protecting your personal belongings should be a top priority, even if you don’t own your home. Renters insurance — also known as an HO-4 policy — is a homeowner’s insurance policy without coverage for the dwelling itself.

We identified the best renters insurance companies of 2020 through conducting more than 150 hours of research, including interviews with experts in the fields of insurance and real estate and vetting 21 insurers. We also analyzed over 400 data points on the companies as a whole — including customer satisfaction scores, complaint ratios, coverage options, and financial strength ratings. For details, read more about our methodology.

Erie Insurance: Best for Comprehensive Coverage

Erie Insurance is a fine choice for renters insurance for many reasons. Among the most important is that it offers several policy bundles that combine its base renters policy with a variety of endorsements.

The Advantage bundle increases coverage limits above base levels and includes identity theft coverage. That added coverage allows you access to a case manager who will help you restore your credit if you’re ever the victim of identity theft or fraud, and may also cover some associated costs of such a breach.

The Plus bundle further increases coverage limits and adds coverage for trailers, watercraft, pets, and business personal property. If you are a freelancer or a small business owner and you keep property related to your business in your home, this coverage will come in handy, as most insurance companies explicitly exclude business personal property from their renters insurance coverage. This bundle also includes higher limits for living expenses and waives the deductible if your loss exceeds $50,000.

Erie’s most comprehensive option is its Select bundle, which includes everything mentioned above but with even higher limits. The package also adds coverage for larger watercraft and reimbursement for the costs of criminal defense. The latter coverage will reimburse legal expenses of up to $25,000 if you successfully fight a criminal indictment against you or your family.

Erie also offers an expansion to its personal liability coverage, offering protection most companies exclude. In addition to bodily injury and property damage, the expansion will also cover personal injury claims due to slander, discrimination, cyberbullying, and other causes.

Other coverages offered by Erie are replacement-cost coverage for your personal property, rather than reimbursement for current value only; comprehensive perils instead of specifically named perils; sewer and drain backup coverage; and coverage for losses caused by guests if you participate in home-sharing.

3rd Party Ratings

- J.D. Power Ranking: #6

- Complaint Ratio: 0.27

- A.M. Best Rating: A+

Nationwide: Best for Optional Add-Ons

Nationwide, one of the 10 largest insurance companies in the United States, offers impressive coverage limits for additional living expenses (ALE) in the event you’re unable to live in your rented property for a while. Whereas most companies offer ALE benefits for a maximum of 12 months, Nationwide offers up to 24 months of coverage. The extra coverage would allow time to, say, rebuild the apartment building you lived in after it was gutted by fire.

Another feature we like is Nationwide’s optional extension for personal property theft, which increases coverage for items stolen while being stored inside your car, boat, or trailer. The company also offers optional coverage for “Brand New Belongings,” meaning the company will help you replace lost items with brand new ones instead of only covering their depreciated cost.

In addition to these coverage features, Nationwide is ranked #5 in customer satisfaction by J.D. Power and has a relatively low 0.60 complaint ratio with the National Association of Insurance Commissioners (NAIC). Paired with Nationwide’s A+ financial strength rating from A.M. Best, these scores make the company an unusually worthy pick.

Renters insurance with Nationwide is not available in Alaska, Hawaii, Louisiana, Massachusetts, or Oklahoma.

3rd Party Ratings

- J.D. Power Ranking: #5

- Complaint Ratio: 0.60

- A.M. Best Rating: A+

Amica Mutual: Best for Customer Experience

Amica Mutual has been top-ranked on the J.D. Power Property Claims Satisfaction Study for almost a decade, proof of its commitment to customer service. As Amica is a mutual insurance company, buying an Amica policy means you’re buying shares in the enterprise. And that, in turn, means you receive dividends you can use to help pay your premium.

Specifically relating to renters insurance, Amica has a program that allows you to earn credits — $100 a year for up to five years — to apply towards a homeowners insurance policy if you ever buy a house and purchase insurance from Amica.

Apart from these benefits, Amica’s renters policies are fairly standard. Optional coverages including those for personal property replacement-cost, additional coverage for smart devices and computers, and identity fraud coverage.

You’re eligible for a loyalty discount after being with Amica for 2 years or more and a reduction in your premium if you’ve been claim-free for 3 years. There’s also a discount for bundling your renters insurance with an Amica car insurance policy.

3rd Party Ratings

- J.D. Power Ranking: #1

- Complaint Ratio: 0.22

- A.M. Best Rating: A+

Lemonade: Most Innovative

Lemonade is a fully online insurance company with an unusual business model. The company takes a fixed percentage of every premium paid to cover its operational costs and then uses the remaining money to pay out covered claims. Whatever funds are left over at the end of the year are donated to a charity chosen by policyholders.

If you need to file a claim, you can do so online or through the company’s app by recording a video of your claim; no need to fill out any forms. Using this approach, Lemonade is able to boast some of the fastest claim processing times in the industry — as little as 3 minutes from application to approval.

With its unusual business model, Lemonade didn’t meet all of the methodology requirements to be included in our short list of Top Picks; it isn’t included in J.D. Power’s 2020 U.S. Property Claims Satisfaction Study, isn’t registered with the NAIC, and has no financial strength rating from A.M. Best. Nonetheless, we believe it deserves serious consideration as one of the best renters insurance companies today.

Lemonade’s base policy is par for the course, with personal property, personal liability, and loss of use coverage all included. You can customize your limits and deductibles to maximize your savings and add scheduled personal property should you need it. You can also get a premium discount by paying the total annual premium up front and by installing protective devices in your home.

Some downsides to Lemonade are that it doesn’t offer a replacement-cost option and, unlike many other companies, its loss-of-use coverage has a dollar limit instead of a time limit. Its policies are also unavailable in more than 20 states. Lemonade renters insurance is available in AZ, AR, CA, CO, CT, GA, IL, IN, IA, MD, MA, MI, MO, NV, NJ, NM, NY, OH, OK, OR, PA, RI, TN, TX, VA, WA, WI, and DC.

Despite a few drawbacks and limitations, Lemonade is an excellent choice for someone looking for an inexpensive renters insurance policy and simple but decent coverage.

Young Alfred

Young Alfred isn’t an insurance company, per se, but rather an online insurance agency and comparison site. After answering a few short questions on the site, you receive quotes from a number of insurers.

While this service is nothing new — there are dozens, if not hundreds, of insurance comparison sites on the internet — Young Alfred stands out in three important ways. First, it only partners with companies rated A- or higher by financial rating firms A.M. Best and Demotech. Second, Young Alfred doesn’t sell your personal information to other companies. And finally, the site also offers a free risk assessment that details the risk of common insurance perils in the location you want to insure. This tool can help you decide whether it’s worthwhile for you to purchase optional policies like earthquake or flood coverage.

OTHER KEY INFORMATION

Methodology

We looked for the best renters insurance companies in the country by first examining customer satisfaction scores in J.D. Power’s 2020 U.S. Property Claims Satisfaction Study and complaint index data for property insurance policies, as compiled by the National Association of Insurance Commissioners (NAIC). We also took into consideration the financial strength of each company as determined by insurance credit rating agency A.M. Best. After an analysis of these factors, and of the policy offerings of each company, we selected our Top Picks. We also included two honorable mentions that did not qualify for Top Pick status based on our methodology, but which nonetheless merit consideration.

Our research began by evaluating the companies in the J.D. Power 2020 U.S. Property Claims Satisfaction Study, which measures how satisfied customers are with the company’s claim settlement, claims servicing, First Notice of Loss (FNOL), estimation, and repair processes. We didn’t consider companies with scores below the industry average.

That left us with eight national insurers for which we calculated the complaint ratio based on data gathered by the National Association of Insurance Commissioners (NAIC). Since larger companies tend to garner more complaints, the complaint ratio provides a way to compare companies of various sizes on an equal footing. To calculate this ratio, we divided the total number of all property insurance complaints lodged against the company by their market share. Companies with a complaint ratio above 1.00 have a higher-than-average incidence of complaints. Thus, we eliminated them.

The next step to whittling down the list of insurers was to examine each company’s financial strength rating from credit-rating agency A.M. Best. A high financial stability rating means the company is less likely to declare bankruptcy in the foreseeable future.

We eliminated companies with a rating below A+ because they have a weaker credit standing and a higher likelihood of being unable to pay out claims.

Renters Insurance Companies by Market Share

Here’s a rundown of the companies that write the most renters’ insurance in the U.S., based on the total value of the policies they issue. Larger companies are likely to have a longer track record and have more agents. But our picks include some relatively small players, which can be innovative and well-priced.

- State Farm: 18%

- Allstate: 8.4%

- USAA: 6.58%

- Liberty Mutual: 6.49%

- Farmers: 5.72%

- Travelers: 4.08%

- American Family: 3.91%

- Nationwide: 3.12%

- Chubb: 2.88%

- Erie Insurance: 1.68%

- Auto-Owners Insurance: 1.64%

- Progressive: 1.59%

- Universal Property: 1.17%

- MetLife: 1.07%

- AIG: 1.06%

What You Need to Know About Renters Insurance

Though renting is seen by some as more expensive than homeownership, that isn’t always the case — and that’s certainly isn’t true when it comes to insurance premiums. Renters have every reason to take out insurance, and when they do the cost should be far lower than for homeowners.

Owning a home almost always requires insuring the dwelling itself, but that isn’t a renters’ responsibility. Consequently, renters’ insurance is far less expensive than homeowners’ as a rule, often costing less than $20 a month.

What it Covers

Renters insurance includes three types of coverage — personal property; personal liability and medical payments to others; and loss of use. (Some insurance companies also include identity-theft protection in renters’ policies; we’ll go over that insurance type later.) Here’s a rundown of those types, with advice on how to decide on the coverage limit you need for each to best protect yourself without overpaying.

Personal Property Coverage

This portion of your policy covers the things you own or use. In many cases, personal property doesn’t need to be inside your home in order to be covered by your renters insurance. You might be able to claim for items lost or damaged while in storage, inside your car, or even in a hotel room when traveling.

Some policies also cover other people’s belongings while they’re in your home. If you have a party, then, and a guest’s purse is stolen, it may be covered under your renters insurance policy.

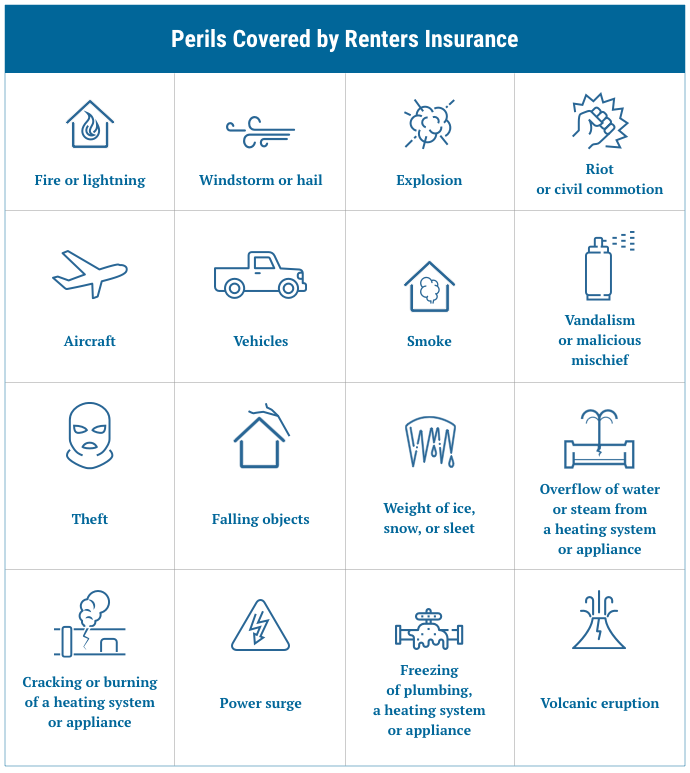

Renters insurance policies vary from company to company, but in general terms, the personal property coverage applies if you suffer a loss or damage caused by any of these perils:

Reading the fine print of your policy is vital, though, because specifics matter when it comes to renters insurance. For example, frozen pipes are covered only if you’re currently staying at home or if you made sure to turn off the water supply before you left the house for an extended period. Vandalism won’t be covered if the residence has been empty for more than 30 days.

The customary coverage of items when they’re outside your home even extends to other countries, in many cases. Wherever the item is lost, you’ll likely need to provide a police report and a detailed inventory of what was lost or stolen. Renters insurance, then, can be a great complement to travel insurance, which may not cover personal items lost on a trip.

Some personal property may be subject to coverage limits under the basic policy. For example, most policies cover only up to $200 in cash, $1,000 in jewelry and furs, and $2,000 for stolen firearms. If the property you want to insure exceeds the covered value, you would have to include some additional personal property coverage, known as a “floater”, that details the specific items you would like to cover and their value. A floater is likely to boost your overall premium, but your valuables would be better protected.

When buying policy, you’ll need to decide whether to opt for coverage on an actual-cash-value basis or a replacement-value basis. Actual cash value coverage pays reimburses you only for the current value of the item at the time the loss happened. If your 4K TV cost $1,600 when you bought it three years ago, the value of the TV —and the amount the insurance will pay you in a settlement — will take into consideration how much the TV has depreciated in three years. That means you might receive less than $1,600, and less than the set would cost to replace. If you select the replacement value option, though, you will be paid whatever the same TV or an equivalent model will cost today. The replacement-cost option will increase your premium.

The actual-cash-value option may be the most cost-effective for most people. But if you own a lot of sophisticated technology or other belongings that would cost far more to replace their current value, it may be worth splurging for replacement-cost coverage.

Determining your coverage limit: To accurately assess the amount of coverage you need for your personal property, prepare a household inventory that documents everything you own, and the value of each item. “Most people have more in property than they think they do,” says Jeff Schneider, president of Gotham Brokerage, a New York-based insurance firm

Even a list may not be enough, according to Scott Holeman, Director of Media Relations at the Insurance Information Institute. Holeman recommends taking photos and recovering original purchase receipts if possible, especially for high-ticket items such as computers, large television sets, and audiophile sound systems. Don’t forget to include belongings that may have accumulated in value over the years, such as collectible books.

And once you’re done? “Don’t store [the record] in your house,” says Holeman. “If you have a fire or a tornado or a hurricane or something that hits you, you don’t want to lose that record.” Instead, keep it in an app or store it in the cloud, at least as a backup.

Personal Liability Coverage and Medical Payments to Others

This coverage protects your assets if someone is injured or suffers damage to their property because of an accident or incident that took place on your property, or for which you may otherwise be legally responsible. If the affected person files a lawsuit against you, insurance can pay for the damages, at least up to the limit you chose when you bought the policy. For example, if your bathtub overflows and floods the apartment below, the personal liability coverage should cover the cost of repairing the ceiling of your downstairs neighbor’s bathroom.

If the incident causes an injury that requires someone else to seek medical assistance, the insurance could also cover that person’s healthcare costs. For example, if your dog bites a houseguest, your guest might file a claim with your insurance company for the cost of stitches to close the bite wound. This coverage even includes funeral costs should the injury result in death.

Keep in mind that this coverage doesn’t apply to you or to people who live with you, even if they’re not listed on the insurance policy. Only guests or other third parties may file a claim for medical payments.

Determining your coverage limit: Since the primary function of a personal liability policy is to protect your assets from a claim, you should calculate your net worth and use that figure as a guide to selecting the amount of your coverage. In the event of a civil lawsuit against you, a judge may calculate the compensation you have to pay based on your present and future wages, any property you own, your savings account, among other assets.

“At the end of the day, what you really want is the liability insurance to be generous enough that no one’s gonna come after your personal assets,” said Professor Daniel Schwarcz of the University of Minnesota Law School.

Loss of Use Coverage

Let’s say a fire ravages your apartment and makes it uninhabitable. If you have renters insurance, you could file a claim for the cost of staying somewhere else while the damage is repaired or until you find a permanent place to live.

This protection is sometimes instead called Additional Living Expenses (ALE) coverage. It may include a hotel room or the rent for another apartment, as well as the costs for meals if you have to eat out instead of cooking at home. You could also claim the cost of boarding a pet, storing property, and even additional transportation costs to get back and forth from work at your temporary accommodation. If you expect to claim under this coverage, remember to keep receipts for all relevant expenses, since those are what the insurance company will use to determine your reimbursement.

Determining your coverage limit: Some companies calculate this coverage based on a percentage of your personal property coverage. “[A] lot of companies, [will] give you 20% of your contents limit as the amount of additional coverage on loss of use. So if you take out a policy for $20,000 of coverage on contents, you’ll have $4,000 to cover your additional living expenses,” said Schneider.

Other insurers instead cover your additional living expenses for a set period of time, usually 12 months. (Some companies may increase this limit for some customers in instances of natural disasters, such as the California wildfires.) If the insurance company sets a dollar limit for your ALEs, you could calculate the coverage limit based on what you think you would need to live in an alternative residence for at least 12 months.

Identity Theft Protection

In addition to the three basic coverage types for renters insurance, many insurance companies also include identity theft coverage to cover the costs of financial recovery after someone uses your financial information or social security number fraudulently.

This coverage often includes a limited amount to reimburse you for any money stolen from your bank account or credit card. Companies are also beginning to include what is known as “credit restoration services,” which can pay attorneys’ fees and cover the cost to hire a fraud specialist who can counsel you through the process of clearing fraudulent charges from your financial records.

This coverage is usually for a set amount, and you can choose to either take it or to waive the option. Some companies charge extra for identity theft protection, while others include it as part of the base policy.

| Average Renters Insurance Claim Costs (2014–2018) |

| Bodily Injury and Property Damage | $17,904 |

| Property Damage Caused by Water Damage and Freezing | $5,177 |

| Vandalism and Malicious Mischief | $3,000 |

| Theft | $2,297 |

| Source: ISO®, a Verisk Analytics® business. |

What Renters Insurance Doesn’t Cover

When buying renters insurance, knowing what it won’t cover, or cover fully, will help you to make any necessary adjustments. Those moves might include taking out additional policies, increasing your coverage limits, or saving money for a rainy day.

Animals

Renters insurance explicitly doesn’t cover the cost to replace animals, including birds or fish. If you have a salt-water aquarium with tropical fish and it’s destroyed during a party, and the fish all die, the tank will be covered by your insurance but the fish that lived in it will not.

Your Roommates

For everything in the residence to be covered, as a rule, all residents must have their own policy. If you take out renters’ insurance for you alone when you’re living with roommates, their property won’t be covered by your policy, unless they’re related to you.

These restrictions also mean that if you accidentally damage the property of one of your roommates or cause an injury to them, your insurance will not apply, because the victim lives with you. If you live with roommates and plan to take out renters’ insurance, encourage them to take out policies for themselves so you can all be covered to the fullest extent.

Flooding or earthquakes

While renters insurance covers damage caused by fire, lightning, wind, and hail, not every natural disaster is covered. If your rental house or apartment floods, or is damaged by an earthquake, insurance will not cover the losses.

It’s important to note a distinction in the case of a storm or hurricane that leads to flooding. Water damage may be covered if it’s due to a window breaking or the roof blowing off and water entering the residence. However, if the water contacts the ground before reaching your home, as with a flood or storm surge, any resulting damage is excluded from coverage.

What if the flooding triggers a fire or explosion, or if your home is looted after you evacuate due to a flood? In these instances, you may be covered for your losses from those perils, but not for any damage caused by the floodwater itself.

What Renters Insurance Can Cost

Renters insurance is relatively inexpensive, especially given the breadth of perils from which it protects you. Since renters insurance doesn’t cover the structure of your home — only your personal property and liability — it’s much more affordable than homeowner’s insurance.

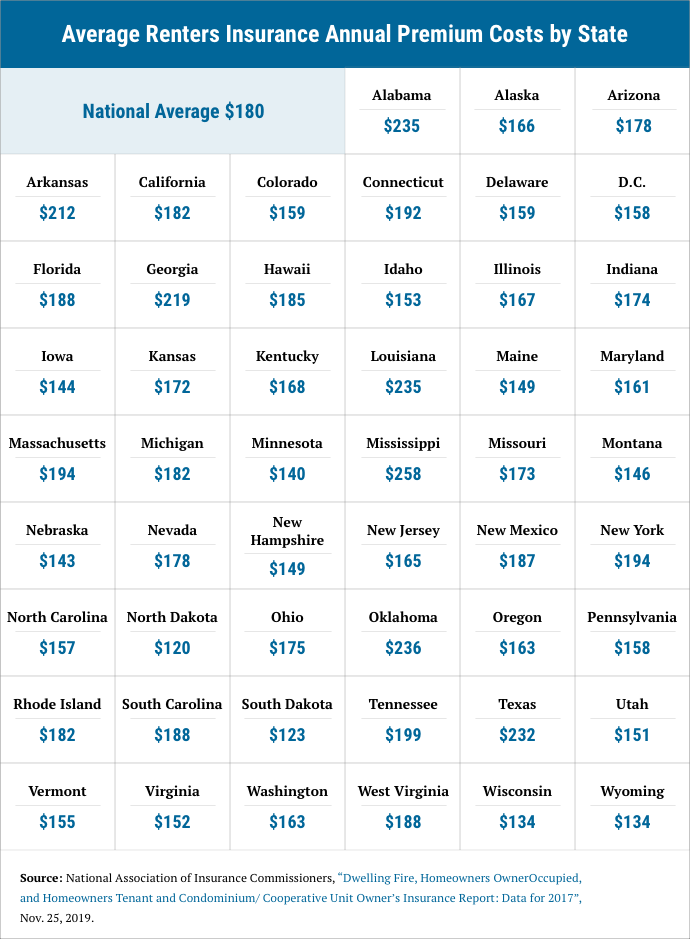

Data from the National Association of Insurance Commissioners (NAIC) shows that the national average cost of renters insurance is a mere $180 annually. That comes down to $15 a month, which is likely less than you pay for, say, streaming video service for your home.

Premiums will vary according to the value you’re seeking to insure and the level of coverage you want, including the size of your deductible. Where you live is also a cost factor, including the prevailing local crime rate and whether inclement weather such as windstorms and fires are common.

The five states where renters insurance is the most expensive on average are Mississippi, Oklahoma, Alabama, Louisiana, and Texas. But even in Mississippi, the state with the highest average premium, the average monthly cost is only $21.50.

Ways to Save

Even though renters insurance is affordable compared to many other types of insurance, it’s still worthwhile to consider ways you can reduce your premium; after all, even small savings can add up over the course of a year or more.

One of the most effective ways to save is simply to shop around because premiums can vary considerably among companies. As you do so, make sure to research companies from which you already hold insurance policies of other types, such as car insurance.

Most companies offer a discount when you purchase (or “bundle,” as the industry calls it) two or more policies from them. “The multi-policy credit for auto and residence coverage is between 10 and 20 percent on each policy,” says Jeff Schneider of Gotham Brokerage. Bundling your insurance also allows you the convenience, if you wish, to pay both bills at once and to consolidate your claims under one account, with a single agent or representative to assist you with questions.

Insurance companies also offer a number of discounts. For example, you can reduce your premium by having safety devices installed around your home, such as cameras, smoke detectors, extinguishers, alarms, smart home devices, and deadbolts. Some companies will also discount your premium after a certain time has elapsed without you filing for a claim. Rate reductions may also be available for signing up for automatic debit from your bank account or for paying your policy annually instead of monthly.

Finally, you can save by choosing a higher deductible — the amount of a claim you have to pay out of your own pocket before the insurance kicks in to cover the remainder of the loss. Some companies offer personal property deductibles of as low as $250, but a small deductible will make your premium higher than opting for the more typical amounts of $500 or $1,000.

Your Renters Insurance Questions Answered

Does my landlord’s policy cover my belongings?

No, your landlord’s insurance won’t cover your belongings, only the actual dwelling or primary structure, other structures like tool sheds and garages, and any maintenance equipment (lawnmowers, leaf blowers, etc.) that the landlord may store on the property.

Is renters insurance required by law

No, renters insurance is not required by law. However, in most states, it is legal for your landlord to require you to have renters insurance as part of your lease or rental agreement. Having a renters insurance policy could be beneficial for your landlord, as it lowers their own liability if one of your guests is injured on the property. You may want to speak with your landlord to see if you can negotiate a discount on your rent payments in exchange for having a renters insurance policy.

Is renters insurance worth buying?

Depending on the value of your personal belongings, renters insurance could be a vital financial safety net. If you own professional equipment such as cameras, computers, or other high-value electronics, a renters insurance policy can protect your investments from vandalism, theft, fires, and power surges. Another plus is that renters insurance will cover your belongings inside or outside of the apartment, including items stolen from your car. To assess the value of your belongings, carry out a home inventory.

How much does renters insurance cost?

Renters insurance is much cheaper than most other types of property insurance. According to the National Association of Insurance Commissioners (NAIC), a renters insurance policy typically costs from $15 to $30 a month, depending on such factors as your location and the value of your belongings.

How do I pick the right renters insurance company?

A relatively low premium cost will likely be the key factor in choosing a renters insurance company, but other considerations should also come into play. First among those is the company’s financial stability, as reflected in its financial strength ratings from reputable credit rating agencies like A.M. Best. While a low strength rating doesn’t necessarily indicate a company is in danger of declaring bankruptcy, a higher rating indicates a higher likelihood that the company will be able to pay your claims, which can provide you with peace of mind.

It’s also worth checking scores and rankings for customer satisfaction with renters insurance, based on surveys from organizations including J.D. Power.

Scott Holeman of the III also recommends doing a background check of the company with your state insurance department. “A company might offer the cheapest solution, but if they’ve got a lot of complaints [in your state], is that going to be the best policy or the kind of policy you want?” he says.

Speaking with an insurance agent or broker can also be helpful. They’re uniquely qualified to provide advice on the type of coverage you need and can answer any questions you may have. If this person is independent — that is, they sell policies from multiple companies — that might be all the more valuable, since they can reliably compare the pros and cons of several potential insurers for you.

Finally, don’t discount word of mouth. Ask your circle of friends or relatives who they’re insured with and about their satisfaction with the company, including any claims experiences they might have had.